What is Direct Primary Care?

As open enrollment begins, it's time to evaluate your healthcare needs for the upcoming year. For many, this means weighing options for health insurance, but there's an often-overlooked healthcare solution that could complement or even replace your traditional insurance plan—Direct Primary Care (DPC).

As a DPC physician, I believe that excellent health insurance does not equal excellent healthcare, and there is no better time than open enrollment to consider how DPC might fit into your healthcare strategy.

What is Direct Primary Care?

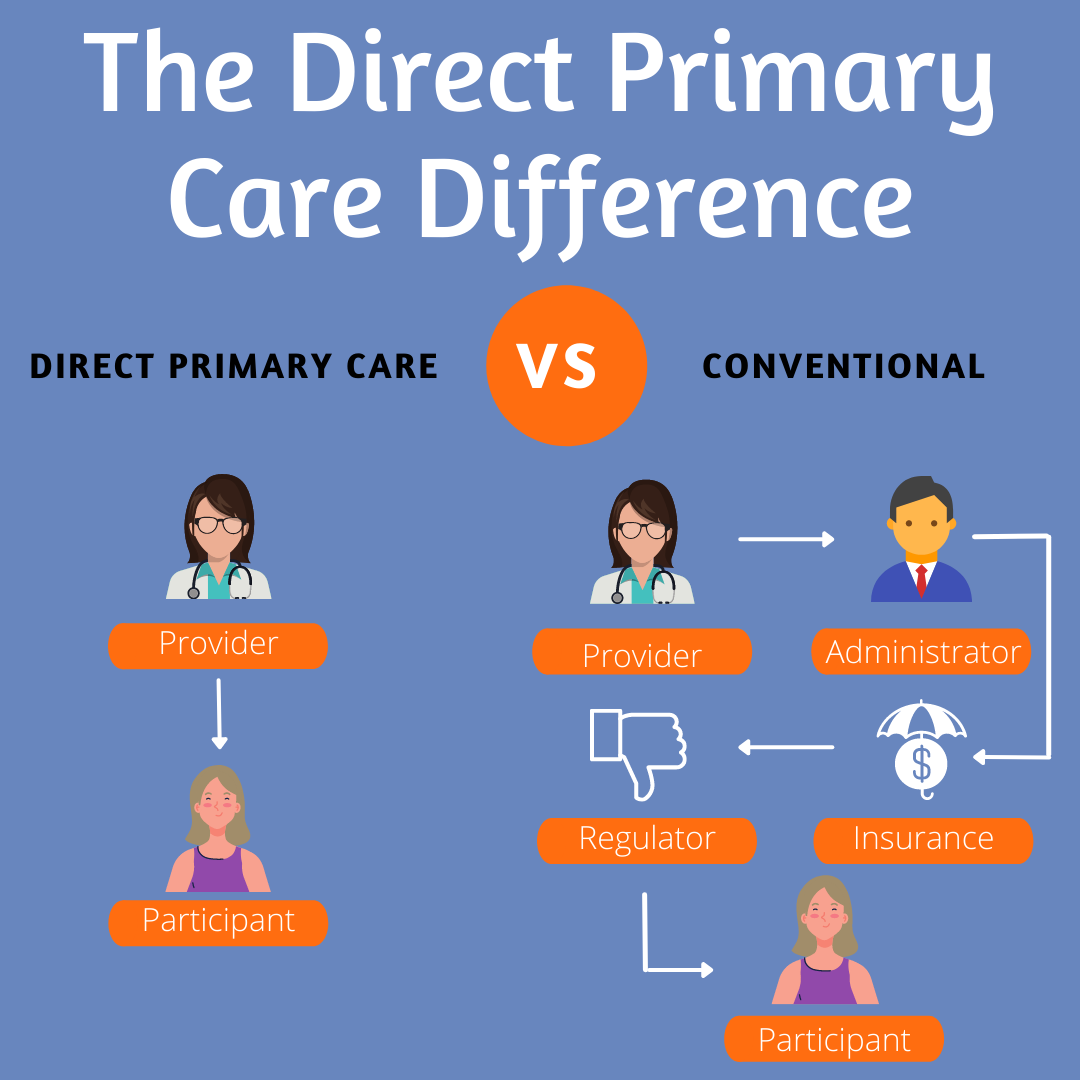

Direct primary care (DPC) is a healthcare business model in which patients purchase a membership that allows them unlimited access to certain primary care services. Direct primary care practices generally do not bill third-party payers (commercial health insurance, Medicaid, Medicare, etc. Instead, the patient pays a monthly fee to the medical office, and can then access care as needed, without paying an additional fee at the time of service.

This monthly membership typically covers:

- Unlimited office visits

- Extended appointment times (30–90 minutes)

- Virtual visits via phone call, text or virtual visit

- Lab work, imaging and generic medications available at wholesale prices

- Chronic disease management

- Preventive care, including wellness visits, screenings, lifestyle counseling

- Same-day or next-day appointments for urgent issues, in-office diagnostics and procedures

How DPC Complements Health Insurance

DPC isn’t health insurance, but it can complement a high-deductible health plan (HDHP) or even a catastrophic insurance plan. If you're relatively healthy and don’t expect to need extensive specialist care or hospital visits, pairing DPC with a lower-cost insurance plan could save you thousands in premiums while giving you direct access to personalized, comprehensive primary care.

Here’s how it works:

1. Routine care is covered under your DPC membership—everything from checkups to managing chronic conditions. No more copays for primary care visits.

2. Major medical expenses are covered by your HDHP or catastrophic plan. If you need hospitalization, surgery, or specialized care, your insurance kicks in.

This strategy allows you to have personalized primary care through DPC without being financially vulnerable if something major happens.

Choosing Health Insurance with Direct Primary Care

During open enrollment, many people default to simply renewing their current health insurance plans. However, this is the perfect opportunity to reassess your health needs and make sure you’re not overpaying for coverage you don’t use.

Here are some reasons why DPC might be the right choice for you:

1. Cost Savings: If you’ve been paying high premiums for a plan you rarely use, consider whether a lower-cost insurance plan combined with DPC might make more sense. DPC allows you to cut back on premiums while still having access to high-quality, consistent primary care.

2. Better Access to Care: One of the frustrations patients often face is how hard it can be to get timely appointments. DPC offers same-day or next-day access, extended appointment times, and direct communication with your doctor—no more waiting for weeks to be seen or rushed appointments.

3. Transparency and Simplicity: With traditional insurance, it’s often difficult to know how much a visit or a procedure will cost until you get the bill. DPC is all about transparency. The monthly membership covers most of your primary care needs, and additional services, like lab tests or medications, are offered at wholesale prices with no surprise bills.

4. Personalized Care: In the traditional system, doctors often have to rush through appointments, seeing dozens of patients a day. In contrast, DPC allows us to take time with each patient, getting to know you and your health history in-depth so we can work together to create a personalized care plan.

Who Should Consider DPC?

- Young, healthy individuals: If you’re generally healthy and don’t use your insurance often, DPC can provide you with preventive and urgent care without the high price tag of full coverage.

- Those with chronic conditions: If you have diabetes, hypertension, or other chronic issues, DPC allows for regular, affordable follow-up visits and proactive care.

- Families: DPC practices often offer family plans, making it easy and affordable to ensure that every member of your household gets consistent care.

- Small business owners or self-employed individuals: If you don’t have access to employer-sponsored insurance, pairing DPC with a high-deductible plan can give you peace of mind without breaking the bank.

Choosing DPC Alongside Your Insurance

When it comes time to make your decisions during open enrollment, consider exploring health insurance plans that will work well with DPC, such as:

- High-deductible health plans (HDHPs): These lower-premium plans are often paired with health savings accounts (HSAs). The idea is that your DPC membership covers routine care, while the insurance plan is there for emergencies.

- Catastrophic health insurance: For those who are relatively healthy and just want insurance for worst-case scenarios, catastrophic plans offer low premiums and high deductibles, making them a good match for DPC.

Final Thoughts: Make Your Healthcare Work for You

The healthcare system is complicated, and it can feel overwhelming to make the right decisions during open enrollment. However, if you're frustrated by long waits, rushed appointments, or rising healthcare costs, Direct Primary Care might be the solution you didn’t know you needed. It’s a model that puts the focus back on you, the patient, and gives you direct access to your doctor without the obstacles that traditional insurance often creates.

Decent.com

This year, when you sit down to choose your insurance plan, take a moment to explore whether DPC is the right fit for you. You might find that combining DPC with a lower-cost insurance plan offers the perfect balance of affordability, access, and personalized care.

If you’d like to learn more about how DPC works or whether it’s a good fit for your healthcare needs, feel free to schedule a Meet and Greet with our office. We're here to answer any questions and help you make informed decisions this open enrollment season!

To learn more about Keystone Direct Health, visit keystonedirecthealth.com or call us at (484) 273-0908.